How to Update Bank Account Info for Stimulus Check

Now, more than ever, you need a reliable, fast, secure, contact-less way to receive your money. The best and fastest way to get your tax refund is to have it electronically deposited for free into your financial account. The IRS program is called direct deposit. You can use it to deposit your refund into one, two or even three accounts.

Eight out of 10 taxpayers get their refunds by using Direct Deposit. It is simple, safe and secure. This is the same electronic transfer system used to deposit nearly 98 percent of all Social Security and Veterans Affairs benefits into millions of accounts.

Combining direct deposit with electronic filing is the fastest way to receive your refund. IRS issues more than 9 out of 10 refunds in less than 21 days. Taxpayers who used direct deposit for their tax returns also received their economic impact payments quicker. You can track your refund using our Where's My Refund? tool.

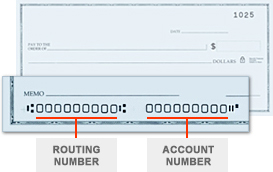

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper. Be sure to double check your entry to avoid errors.

Don't have a check available to locate your routing and account number? A routing number identifies the location of the bank's branch where you opened your account and most banks list their routing numbers on their websites. Your account number can usually be located by signing into your online banking account or by calling your bank branch.

If you have a prepaid debit card, you may be able to have your refund applied to the card. Many reloadable prepaid cards have account and routing numbers that you could provide to the IRS. You would need to check with the financial institution to ensure your card can be used and to obtain the routing number and account number, which may be different from the card number.

Don't have a bank account?Visit the FDIC website or the National Credit Union Administration using their Credit Union Locator Tool for information on where to find a bank or credit union that can open an account online and how to choose the right account for you. If you are a Veteran, see the Veterans Benefits Banking Program (VBBP) for access to financial services at participating banks. You can also ask your preparer if they have other electronic payment options that they offer.

Direct deposit also saves you money. It costs the nation's taxpayers more than $1 for every paper refund check issued, but only a dime for each direct deposit made.

The federal tax refund is often the largest single check many people receive. It's an opportune time to start or add to your savings. You can divide your refund into two or three additional financial accounts, including your Individual Retirement Account, or purchase up to $5,000 in U.S. Series I Savings Bonds.

Splitting your refund is easy. You can use your tax software to do it electronically. Or, use IRS' Form 8888, Allocation of RefundPDF (including Savings Bond Purchases) if you file a paper return. Just follow the instructions on the form. If you want IRS to deposit your refund into just one account, use the direct deposit line on your tax form.

With split refunds, you have a convenient option for managing your money — sending some of your refund to an account for immediate use and some for future savings — teamed with the speed and safety of direct deposit.

Your refund should only be deposited directly into a U.S. bank or U.S. bank affiliated accounts that are in your own name; your spouse's name or both if it's a joint account. No more than three electronic refunds can be deposited into a single financial account or pre-paid debit card. Taxpayers who exceed the limit will receive an IRS notice and a paper refund.

Whether you file electronically or on paper, direct deposit gives you access to your refund faster than a paper check.

Related Items:

- Frequently Asked Questions about Splitting Federal Income Tax Refunds

- Form 8888, Allocation of Refund (Including Savings Bond PurchasesPDF

- Buying U.S. Series I Savings Bonds with your tax refund

- Frequently Asked Questions about buying U.S. Series I Savings Bonds with your refund

- Where's My Refund?

- Direct Deposit Limits

How to Update Bank Account Info for Stimulus Check

Source: https://www.irs.gov/refunds/get-your-refund-faster-tell-irs-to-direct-deposit-your-refund-to-one-two-or-three-accounts